Introduction

Navigating through the complexities of tax systems in different countries can be a daunting task. Two common forms of consumption taxes that are often confused are the Value Added Tax (VAT) in the United Kingdom and the Goods and Services Tax (GST) in Australia. This article aims to demystify these taxes by exploring their definitions, origins, importance, and key differences.

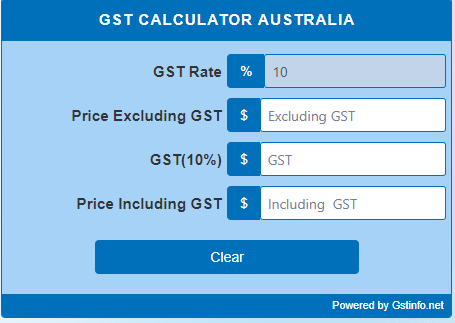

VAT and GST calculator

For those in the UK, there are online VAT calculator UK available which provide a user-friendly interface for quickly determining the Value Added Tax on goods and services. These calculators allow users to easily compute both VAT-inclusive and VAT-exclusive prices, making them invaluable for businesses, accountants, and consumers. In Australia, GST calculator Australia serves a similar purpose, offering a straightforward way to calculate the 10% Goods and Services Tax applied to most goods and services.

These tools are particularly beneficial for small business owners and individuals, helping them to accurately figure out the GST component of their transactions. Both types of calculators are designed to simplify tax calculations, ensuring compliance and aiding in financial planning.

VAT in the UK: An Overview

Value Added Tax (VAT) in the UK is a consumption tax placed on a product whenever value is added at each stage of the supply chain, from production to the point of sale. The amount of VAT that the user pays is on the cost of the product, less any of the costs of materials used in the product that have already been taxed.

History of VAT in the UK

VAT was introduced in the UK in 1973 as a condition of the UK’s admission to the European Economic Community. Over the years, the standard rate of VAT has changed, reflecting the economic policies of successive governments. As of now, the standard rate is 20%, with reduced rates of 5% and a zero rate on certain goods and services.

Importance of VAT in the UK

VAT is a significant source of revenue for the UK government, contributing to a substantial portion of the total tax revenue. It is crucial for funding public services and maintaining economic stability. VAT is also adjustable, which allows the government to control consumer spending to some extent.

GST in Australia: An Overview

The Goods and Services Tax (GST) in Australia is a broad-based tax of 10% on most goods, services, and other items sold or consumed in Australia. Unlike VAT, GST is a flat rate and is not subject to frequent changes.

History of GST in Australia

GST was introduced in Australia on July 1, 2000, by the Howard Government as part of a major tax reform package. The introduction of GST was meant to replace the previous inefficient system of sales tax and to provide a steady revenue stream.

Importance of GST in Australia

GST is a critical component of Australia’s taxation system, providing a consistent revenue stream that funds essential public services and infrastructure. It’s also seen as a way to make the taxation system more efficient and fair, spreading the tax burden across a broader base.

Comparing VAT in the UK and GST in Australia

Rate Variability One of the most significant differences between the two is the variability in rates. The UK’s VAT has multiple rates, including a standard rate of 20%, a reduced rate of 5%, and a zero rate. In contrast, Australia’s GST is a flat rate of 10% across all eligible goods and services.

2. Scope and Exemptions

Both VAT and GST have exemptions, but they differ in scope and nature. In the UK, items like food, children’s clothing, and books are typically zero-rated. In Australia, GST exemptions include some food items, healthcare, and educational services.

3. Revenue Distribution

In the UK, VAT revenue goes to the central government. In Australia, GST revenue is collected by the federal government but then distributed to the states and territories, playing a crucial role in state financing.

4. Administration and Compliance

The administration of VAT in the UK is handled by HM Revenue and Customs (HMRC), while in Australia, the Australian Taxation Office (ATO) manages GST. Compliance requirements, while broadly similar, have nuances specific to each country’s legal and business environments.

5. Impact on Business

Both taxes impact businesses significantly but in different ways. UK businesses dealing with various VAT rates must navigate a more complex accounting process. Australian businesses, while dealing with a single GST rate, must consider the implications of GST on cash flow and pricing strategies.

6. International Considerations

For international trade, both VAT and GST have implications. In the UK, VAT is charged on goods and services within the country and on imports from non-EU countries. In Australia, GST is charged on imports but is generally refunded for exports.

7. Economic Impact

Both VAT and GST affect consumer spending, inflation, and overall economic health. Changes in VAT rates in the UK can significantly impact consumer behavior, while the flat rate of GST in Australia provides a more predictable but less flexible economic tool.

Conclusion

Understanding the differences between VAT in the UK and GST in Australia is crucial for businesses operating internationally and for individuals trying to comprehend their tax obligations. While both serve the same purpose of taxing consumption, their implementation, rates, and impact vary significantly.

These differences reflect the economic policies, administrative practices, and historical contexts of the two countries. As global economic dynamics continue to evolve, so will the structures and roles of VAT and GST, underscoring the importance of staying informed and adaptable in a changing fiscal landscape.